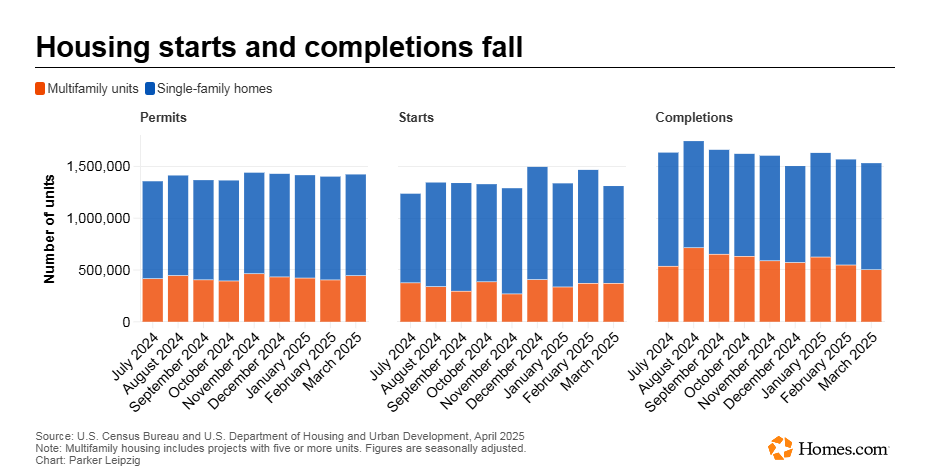

U.S. housing starts are on the decline, falling to the lowest level in eight months as builders and buyers grapple with the impact of cost increases caused by tariffs.

Builders started a seasonally adjusted 1.324 million homes in March, down 11.4% from the revised February total but 1.9% above the number in March 2024, according to figures released Thursday by the U.S. Census Bureau and the Department of Housing and Urban Development. Single-family starts dropped to a seasonally adjusted 940,000, down 14.2% from February and 9.6% from a year earlier.

“The drop in March housing starts is a clear signal that affordability pressures are intensifying,” said Buddy Hughes, chairman of the National Association of Home Builders, in a statement. “Elevated mortgage rates and rising construction costs are making it increasingly difficult to deliver homes at price points accessible to entry-level buyers.”

A survey of homebuilders released Wednesday showed waning sentiment due to tariffs, labor shortages and a lack of land. What’s more, 60% of respondents reported suppliers have increased material costs or plan to because of the tariffs, according to the NAHB/Wells Fargo Housing Market Index.

The March report could be a precursor of what’s to come the rest of the year for new housing, given the economic uncertainty combined with cost concerns, according to an analysis by research firm Oxford Economics.

While the government data showed the forward-looking indicator of building permits increased 1.6% from February due to a rise in multifamily activity, lead Oxford economist Nancy Vanden Houten described that as “more noise than signal” and said that likely won’t lead to an uptick in multifamily construction.

March housing completions totaled a seasonally adjusted annual rate of 1.549 million, down 2.1% from the revised February estimate but up 3.9% from March 2024.

Though the report offered a subdued take on the homebuilding industry, builders still have the advantage over existing home sellers of buying down mortgage rates to make buyers’ monthly payments more manageable.

“Housing affordability is yet another headwind, as buyers face the double whammy of elevated mortgage rates and prices,” said Odeta Kushi, deputy chief economist at First American, a title insurance and settlement services firm, in an email. “However, the recent decline in mortgage rates and the growing use of sales incentives may help to coax some buyers off the sidelines.”

By Paul Owers