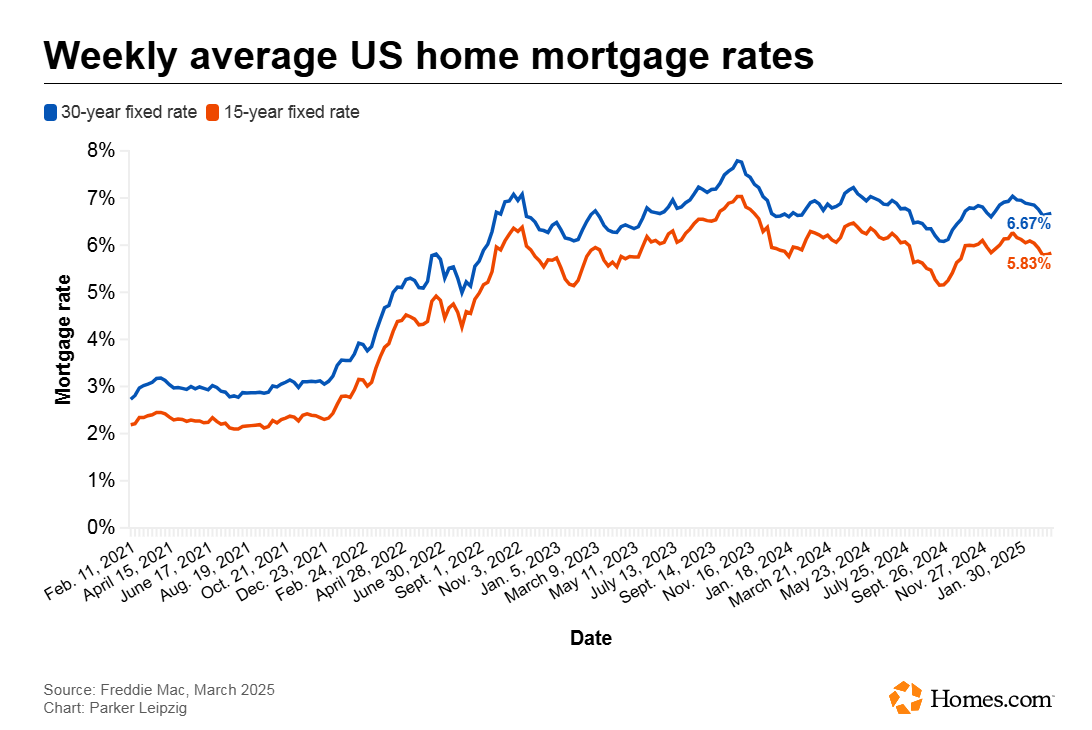

The average 30-year, fixed rate trended downward as the economy has softened Mortgage rates eked slightly higher for the second consecutive week — but they’re still lower than this time last year.

The 30-year, fixed-rate mortgage averaged 6.67% in the week ended Thursday, according to mortgage giant Freddie Mac, a buyer of loans from banks. At the same time, data from Mortgage News Daily showed that on a daily basis, the 30-year, fixed-rate mortgage had fallen to 6.76% by the end of Wednesday.

Despite the slight increase, Sam Khater, chief economist at Freddie Mac, noted that the average has been under 7% for nine straight weeks, “which is helpful for potential buyers and sellers alike.”

Moreover, the rate is still hovering near its lowest average since December.

The 15-year, fixed-rate average, popular with homeowners looking to refinance to a lower rate, also increased slightly, climbing to 5.8% from 5.79%, according to Freddie Mac. Mortgage News Daily’s measure showed that rate was slightly higher than the previous day, at 6.24% as of Thursday afternoon.

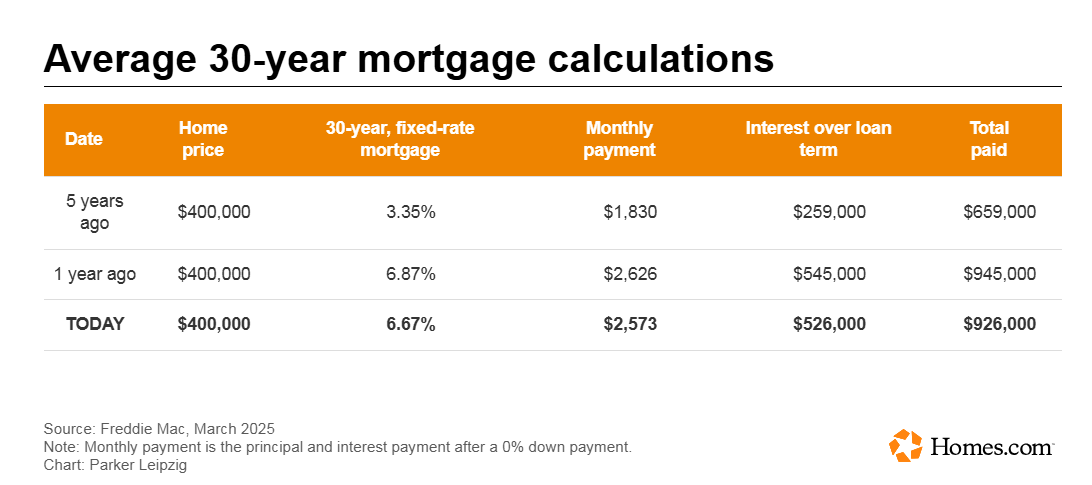

Taking a big-picture look, the 30-year, fixed-rate average is lower than it was during the comparable week last year. Put another way, if a homebuyer purchased a $400,000 house with no down payment last year, they’d be paying about $545,000 in interest over the term of that mortgage. For that same purchase today, a buyer would pay about $526,000 in interest over the 30 years.

‘Bad news is good news for mortgage rates’

It’s an update that comes less than 24 hours after the Federal Reserve announced yesterday it would be holding short-term interest rates steady. Though the central bank does not set mortgage rates, it creates expectations about where the economy is headed. Those forecasts often influence investor behavior and that often leads to reactions in the mortgage market.

Yesterday, for example, although the Fed left interest rates untouched, it sent a message: The economy is healthy enough to keep things as they are, but “uncertainty around the economic outlook has increased.”

That sentiment was enough to make investors act by putting their equity into the market for 10-year treasury bonds, often considered a safer move during economic uncertainty. As bond yields fall from investor activity, mortgage rates typically follow the same trend.

Daily rates are generally more reactive than weekly averages, too, so they are more likely to reflect even the slightest volatility, like a Fed announcement. The effect on the weekly average, though, may not be felt in full until next week.

The takeaway is that although mortgage rates are falling, the movement might not be for the right reasons, according to Melissa Cohn, regional vice president of William Raveis Mortgage. Investors are worried about potential tariffs, inflation and the job market, and though the response has been positive for rates thus far, uncertainty in the market isn’t ideal.

“Bad news is good news for mortgage rates,” Cohn said in an interview. “It’s a strange concept, but mortgage rates live in this very contrarian world.”

By Moira Ritter